Although Netflix was considered to be one of the most demanded stocks in 2015, it did not do so great this year. Its earnings report for the second quarter shows that the prices of shares decreased. Netflix did not meet its prediction of 2.5 million new customers either, which does not look too well for the company’s future.

Netflix claims that the reason for its decreased growth in subscribers is due to their primary customers unsubscribing from the popular entertainment company.

This process of older members leaving, known as churn, unexpectedly grew once Netflix announced that they were planning on ungrandfathering older members. This would make the new, higher prices effective for older audiences. This drove away some older members and contributed to the decrease in revenue. Instead of viewing this change as an end to grandfathering for two years, many long-term members viewed it as an increase in prices. This can be to blame when it comes to the decrease in stock prices for Netflix.

Even with the loss of revenue due to people unsubscribing from Netflix, the company states that ungrandfathering will provide the company with a greater amount of revenue with which they can use to create more and better content.

The company believes this will contribute to the growth of subscribers in the long run.

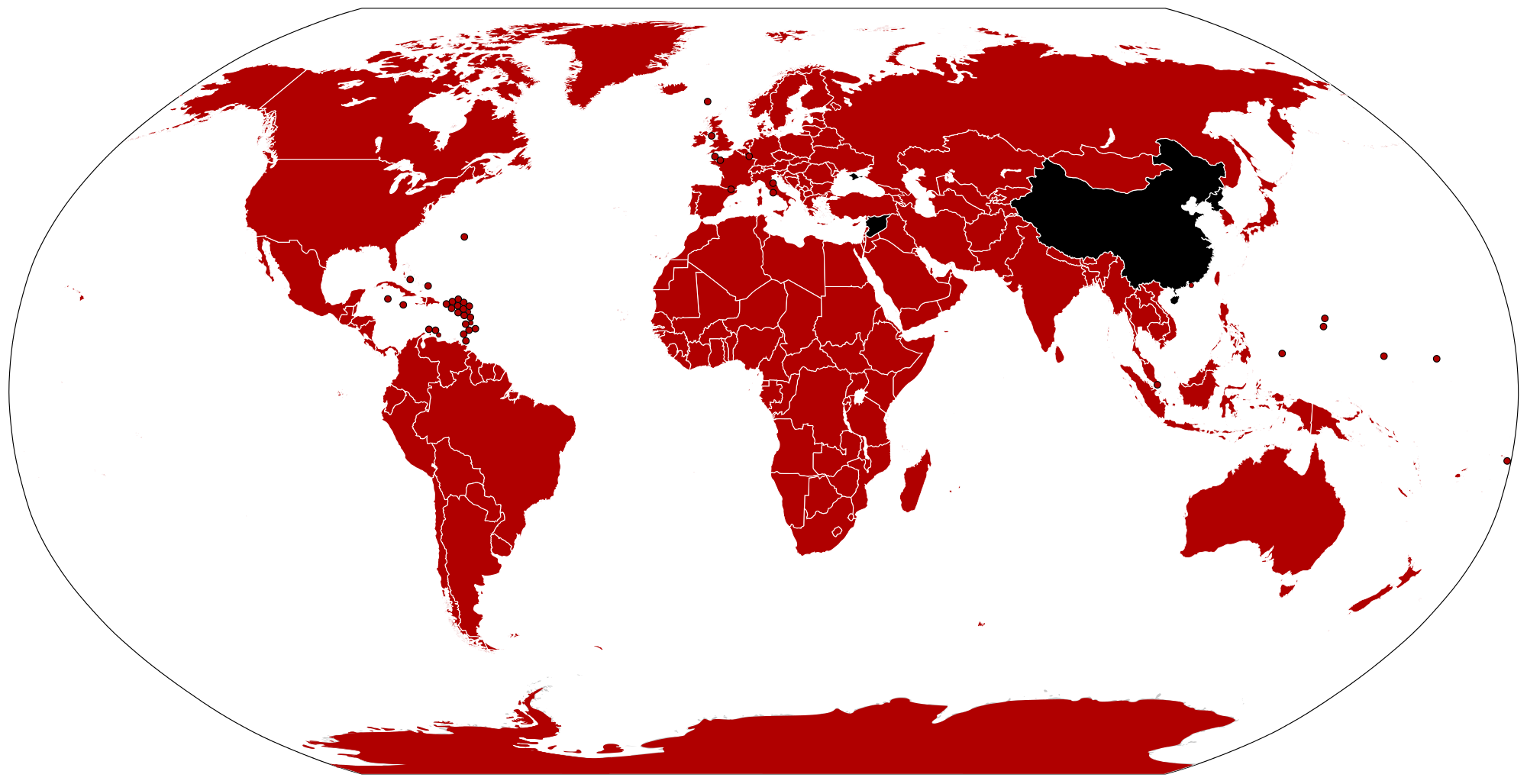

With Netflix exceeding expectations with its growth in the previous years, that growth seems to have come to a halt. After expanding to 130 countries, Netflix needs to develop new ideas and partnerships to spur growth. This can include teaming up with other ca

There doesn’t not seem to be a projection of Netflix stock prices increasing any time soon, but the company may gain access to Comcast’s X1 box. Nothing is certain yet, but both companies will only take action if it guarantees a positive experience for viewers.